E-Commerce Payment Platforms: Navigating the Top Trends of 2024

Cash or credit? That’s old school. In 2024, e-commerce payment platforms trends are reshaping how we buy. From tapping phones to one-click buys, paying online is getting a major upgrade. I’m diving into the freshest trends that are changing the game for shoppers and stores alike. Ready to see what’s making waves? Keep reading, and let’s unlock the secrets of smooth and secure online payments that are setting the stage for the future of e-commerce.

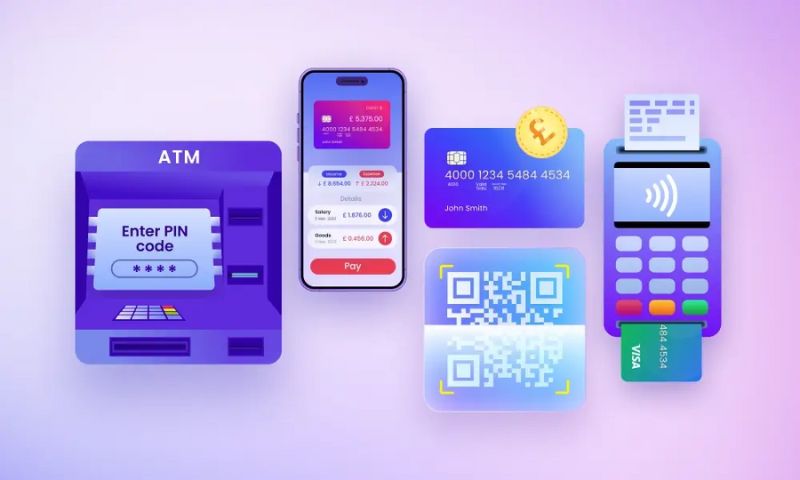

The Rise of Contactless and Mobile Payment Solutions

Exploring the Surge in NFC and QR Code Payments

Have you seen people pay by tapping their phones? That’s NFC. It’s a hot trend. NFC stands for Near Field Communication. It makes paying fast and touch-free. Stores are loving NFC too. More and more are saying “yes” to this tech.

QR codes are everywhere now. You’ve seen those square barcodes, right? Quick and easy, that’s why they’re big news. Just scan and pay. It’s that simple. No cards, no hassle. It’s all part of contactless transactions growing like crazy.

The Expansion of Digital Wallets and Mobile Payment Apps

Flip open your phone and what do you see? Apps! And some of the best are wallets. No, not to hold cash, but for paying with a tap. Digital wallets are like magic pockets. They keep your money safe but ready to use quick. Mobile payment solutions are not just a trend—they’re the new wallet.

Guess what? You can use these apps in lots of places. Buying online? Check. Paying back friends? Easy. Even in some taxis. With everyone using phones for pretty much everything, it’s no shock we’re paying with them too.

The world’s going mobile, and our money’s along for the ride. We love things fast and secure, and that’s just what these apps offer. Plus, who wants to carry a bunch of cards? Not me. Mobile payment apps mean less to carry and more to do.

Buying things should be smooth sailing. That’s where one-click checkout comes in. It’s getting better all the time. One tap and you’re done. No more fill-this-out, enter-that-code. It’s a shopper’s dream.

And remember, fast is great, but safety’s king. Secure payment protocols make sure no one sees your info but you. With every tap and scan, we’re safe and sound.

What’s shaping the way we buy? NFC payments adoption, for sure. And don’t forget the QR code payment surge. We’re on a ride to the future, and these trends are driving. Keep your eyes open. Mobile pay’s just going to get bigger and better.

The New Wave of Payment Security and Authentication

Implementing Biometric Verifications and Strong Customer Authentication (SCA)

Safety first, right? That’s what we all want when we buy online. Now, exciting stuff is happening to keep our money safe. We’ve got new ways to check who you are when you pay. Imagine paying with just your face or fingerprint. That’s biometric checks. These make sure it’s really you. Shops now use Strong Customer Authentication (SCA) a lot. SCA makes you prove your identity twice. So, if anyone’s up to no good, it’s tougher for them.

What’s cool is, this is not just for high-tech places. Small shops and big ones are all getting on board. The law in some places, like Europe’s PSD2, asks for this kind of safety too. This means safety is a big deal everywhere.

Advances in AI and Machine Learning for Robust Fraud Prevention

Now let’s talk about fraud. No one likes it. This is where AI and machine learning come to play. They work like a smart guard that learns on the job. AI looks for patterns to stop fraud before it starts. Let’s call it a behind-the-scenes hero. It checks tons of payments at once to find anything fishy.

The best part? AI keeps getting better. As it learns, it gets faster at finding cons. For your shop, this means fewer bad deals. For you as a buyer, it means you can relax more.

AI can also help spot good buyers faster. This means when folks shop a lot and are good for it, they can skip some checks. So, good buyers find it easy to shop, while crooks get the boot.

And guess what, it does not stop here. The people making these smart systems keep adding new tricks. So, we can all feel safer when we click ‘buy’.

Now you might wonder, how does this affect your shop or your buying? Well, it’s pretty simple. You’ll see more of this stuff over time. It’s going to be a big part of shopping online. When you pay, these smart tools work in a flash to protect your cash.

Remember, all this fancy tech is here for one reason: to make buying and selling smooth and safe. So, next time you shop online, take it easy. There’s a lot of brainy tech working to keep your money safe.

The Growth of Alternative Payment Methods

The Increasing Popularity of Buy Now Pay Later Services

Let’s talk about a hot trend: Buy Now Pay Later (BNPL). Have you heard about it? It lets you buy something now and pay for it later or in parts. It’s like having a short-term loan without the huge fees. More and more, people are choosing BNPL. Why, you ask? Because it’s super easy and your wallet feels less pinch at once. Imagine you want those cool kicks you saw online. With BNPL, you can wear them now and pay in bits. So, stores love it cause people buy more. It’s that simple – and it’s growing fast.

We’ve seen BNPL leaders like Afterpay shaking things up in stores and online too. Smaller payments are easier to handle than one big chunk of cash. Plus, who doesn’t like to spread their costs out? Sure, this might lead you to spend more sometimes. That’s part of why everyone’s talking about BNPL right now.

Cryptocurrencies and Blockchain Technology in Online Shopping

Next up: cryptocurrencies and blockchain. Tons of folks are talking about using Bitcoin and others to shop online. It’s cool but kinda tricky. Think of it like using digital coins. These coins live on a thing called blockchain, which keeps your shopping super safe. But remember, the prices of these coins can go up and down a lot. You could buy a game today and the cost in coins could change tomorrow. So, be sure to check it out first.

Paying with crypto means no bank in the middle. It goes right from you to the store. It’s quick and crosses borders with no sweat. Want to buy a toy from a shop on the other side of the world? You can! With crypto, it’s as easy as buying from your neighbor.

Some folks worry about safety with this stuff. But that’s where blockchain shines. It’s like a digital log that’s really tough to mess with. Think of it as a guard that watches over your coins. Cool, right? And as online shopping grows, so does the use of crypto. It’s getting easier to pay this way. Plus, you don’t have to stress about giving out card details.

So, do keep an eye on BNPL and crypto next time you shop online. They could make buying stuff easier and maybe even fun. The key is to understand how they work so you can shop smart. And trust me, we’re going to see a lot more of these in the future. Shops want you to have the easiest time paying, and these trends are how they’re doing it.

Streamlining the Checkout Experience and Beyond

Optimizing One-Click Checkout for Enhanced User Experience

One-click checkouts make shopping easy. They save time and cut hassle. As an expert, I see big growth here. More stores now add this quick-pay feature. It’s key for happy buyers and more sales. Why? It’s simple: tap once, and you’re done. No long forms, no waiting. This boosts buys on phones and tablets too. Stores must keep this easy and safe, though. They use secure payment protocols to protect your money.

Cross-Border Payment Processing and Multi-Currency Support Systems

Shoppers today buy from all over the world. They want to pay in their own money. That’s where cross-border processing and multi-currency support systems shine. This tech lets you pay in your currency, even from far away. It’s good for folks selling too. They reach buyers across seas without fuss. Payment gateways keep getting better, connecting more places, more banks. They also make sure to follow rules like PSD2, helping everyone trust the deal. This trend will keep growing, as shopping knows no borders.

In this post, we dove into the big trends in e-commerce payments for 2024. We saw how tap-and-go and mobile wallet solutions are taking over. These methods make checking out fast and easy for shoppers everywhere.

We also checked out new security measures like biometric checks and smarter AI. These tech tools are fighting fraud to keep our money safe.

Then, we looked at cool new options for paying, like “Buy Now Pay Later” and paying with crypto. These choices give more power to buyers to shop how they want.

To wrap up, a smooth checkout is key, and now it’s getting even better. Quick clicks and paying in different currencies are game changers for shopping across borders.

I hope these insights help you keep up with the fast-paced world of online payments. Stay safe and happy shopping!

Q&A :

What are the latest trends in e-commerce payment platforms?

With online shopping reaching new heights, e-commerce payment platforms are rapidly evolving. The latest trends include increased adoption of mobile and contactless payments, integration with social media platforms for seamless checkouts, and the rise of cryptocurrency as a legitimate payment method. Additionally, payment platforms are emphasizing security with advanced technologies like biometrics, and offering more personalized and flexible payment options to improve customer experience.

How is mobile payment technology influencing e-commerce payment platforms?

Mobile payment technology is significantly influencing e-commerce payment platforms by facilitating faster and more convenient transactions directly from smartphones. This shift is driven by the widespread use of mobile wallets like Apple Pay and Google Wallet, which simplify the checkout process and enhance security with features like tokenization. Moreover, mobile payments encourage in-app purchases and one-click ordering, making payment methods in e-commerce more integrated with the consumers’ daily lives.

Are cryptocurrencies becoming a mainstream payment option in e-commerce platforms?

Cryptocurrencies are gradually gaining traction in e-commerce as an alternative payment option. With major companies and online retailers starting to accept cryptocurrencies like Bitcoin, Ethereum, and others, they are moving towards the mainstream. The decentralized nature and potential for lower transaction fees make them an attractive option for both merchants and consumers. While not yet widely accepted, the trend indicates a growing interest in incorporating cryptocurrency payments into e-commerce platforms.

How do advanced security measures impact e-commerce payment platform trends?

Advanced security measures are front and center in the evolution of e-commerce payment platform trends. With the implementation of technologies like biometrics for authentication, 3-D Secure for fraud prevention, and encryption standards for data protection, consumers are gaining confidence in online transactions. This heightened security environment not only guards against data breaches and cyber attacks but also drives the adoption of new payment technologies as users feel more secure in their online transactions.

What role does payment flexibility play in e-commerce platform preferences?

Payment flexibility is becoming an increasingly important factor in e-commerce platform preferences. By offering a variety of payment options, including buy now, pay later services, interest-free installments, and real-time bank transfers, e-commerce platforms can cater to different customer needs and budget constraints. This trend towards accommodating diverse payment preferences is instrumental in reducing cart abandonment, enhancing customer loyalty, and driving overall sales growth.