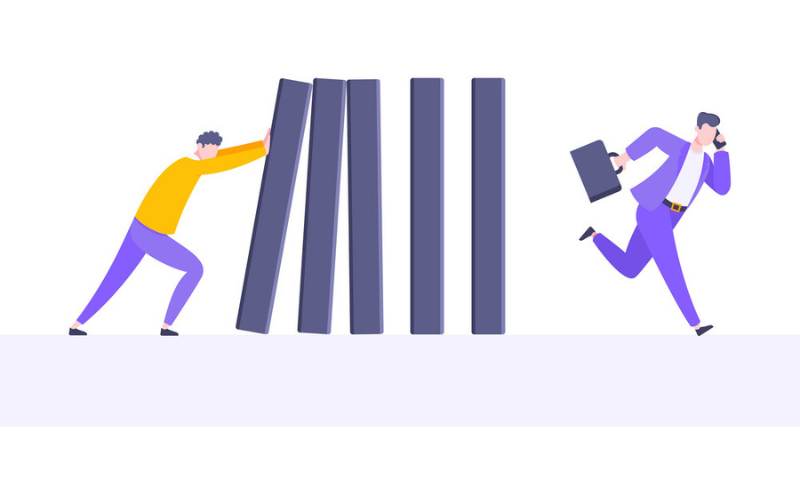

Ever felt the tremors of central bank interest rates impact? You’re not alone. These rates spark a chain of events that can shake up your wallet and the world’s markets. It’s like a game of dominoes — push one, and they all start to topple. Let’s dig into how these crucial rates lead the dance of our economy, affect your monthly budget, and even sway global financial tides. From the cash in your pocket to the growth of your nest egg, the reach of central bank decisions stretches far and wide. Ready to see how the puzzle pieces fit together? Let’s unveil the economic domino effect that is hinged on these powerful numbers.

Understanding Central Bank Interest Rate Mechanisms

Interest Rate Adjustments and Monetary Policy Influence

Think of a central bank as the big boss of money. They control how much it costs to borrow money. This is called the interest rate. When the bank changes this rate, it’s like making a wave in a giant pool. Everything gets shaken up. Less costly loans can boost business and help folks spend more. But if loans cost too much, people might stop spending.

Central banks use this power to keep the economy just right. Not too hot, with prices soaring, and not too cold, with no one buying stuff. It’s a delicate dance, and getting it on point is key. When we talk about the Federal Reserve, or “the Fed,” they’re the ones doing this dance in the U.S.

Now, let’s say I want to buy a house or start a business. The interest rate the central bank sets influences the rate of my mortgage or business loan. The bank’s goal is to keep things balanced, like inflation and economic growth. They want a steady pace, so we all keep moving forward.

The Role of the Federal Reserve in Economic Steering

Heading the charge in the U.S. is the Federal Reserve. They use monetary policy, which is a fancy way of saying they manage money supply and interest rates. By doing this, they guide the economy. When people ask what the Fed does, it’s simple. They control the cash flow. This means how much money is out there and how much it costs to get your hands on it, which impacts jobs, business health, and how much stuff costs.

They adjust interest rates to help us out. If things look grim, they cut rates to cheer up the economy. This means cheaper loans for all. If the economy is partying too hard, they hike up rates. This cools down spending and stops prices from rocketing too high.

For example, if the Fed drops the rate, loans become less pricey. Businesses say “let’s invest and create jobs.” This is fantastic for workers. But if the Fed hikes up rates too much, things can slow down fast. This scares businesses and can mean trouble for jobs.

It’s not just about the U.S., either. The Fed’s moves make waves around the globe. Other countries watch what they do, like for clues in a game. Changes here can mean changes way over there too.

Whether it’s saving for a sunny day, buying a home, or running a store, what the Fed does touches all our lives. They’re like the captain of a ship, trying to sail us through calm waters. But steering this large vessel comes with huge responsibility. They’ve got to watch for storms and keep us safe while moving ahead. It’s a tough job, but someone’s got to do it, right? And we all depend on them to do it well.

The Ripple Effects of Interest Rate Changes on the Economy

Inflation Targeting and Interest Rate Dynamics

When central banks tweak interest rates, it’s like setting off a line of dominoes. Each change leads to another, affecting everything from what you pay on loans to how much your savings grow. This chain reaction starts with inflation targeting. By changing interest rates, central banks aim to keep prices stable. Suddenly, borrowing can either cost you more or less. This one move starts to touch all parts of the economy.

If a central bank, like the Federal Reserve, raises rates, they are saying, “Let’s slow things down a bit.” High rates make loans pricier. This means people might think twice before buying something big, like a house. Fewer loans translate to less money swirling around. Typically, this cools off price hikes, which is the main goal. On the flip side, if rates fall, it’s like a green light for spending and borrowing. Prices may then start to climb as demand for goods goes up.

This balancing act is all about keeping inflation just right, not too high or too low. When it works, your money buys about the same as yesterday and the day before. That’s what everyone wants—a stable and predictable cost for life’s needs.

The Symbiotic Relationship between Economic Growth and Central Bank Rates

Let’s talk about how rate changes and growth hold hands. Economic growth means more jobs and better wages. It leads to people spending more, and that’s when businesses thrive. But to get there, sometimes you need a boost from low interest rates to encourage borrowing and investing. Companies expand, hire more folks, and the wheels of growth spin faster.

Central bank rates are the fuel for this engine. Cut the rates, and you’ve got a recipe for growth. Businesses borrow at low costs and expand. More jobs pop up and wallets get fatter. But central banks watch closely. If things heat up too much, they might hike rates. This makes borrowing costlier. Companies might then hit the brakes on expansion, and hiring can slow down.

It’s a dance between growth and rates. You want enough growth to keep everyone happy but not so much that prices shoot through the roof. So, central banks pull the rate levers carefully. They’re trying to keep that sweet spot where businesses grow, jobs are plenty, but your coffee doesn’t cost more each morning.

Every time rates change, it’s not just about numbers. It’s about what’s in your pocket and on your job desk. Whether you’re saving for a rainy day or planning a big purchase, what the central bank decides can make your day or throw a wrench in your plans. That’s the power of interest rates — a force unseen but felt in countless ways across the economy.

Direct Impacts of Rate Fluctuations on Financial Products

Mortgage Rates Fluctuation and Housing Market

When central banks tweak interest rates, your home dreams feel it. Let’s say the Federal Reserve hikes rates. This usually makes mortgage costs climb, too. Banks and lenders often follow the Fed’s lead. They raise what they charge for loans. This means you might pay more each month for a house.

Now imagine if rates fall. The same house could cost you less per month. This makes buyers excited! They rush to get good deals. More homes sell, and fast. Builders see this. They build more houses to keep up. A whole market moves just because of interest rates.

Loan Interest Changes and Their Effect on Consumer Spending

Loans are not just for homes. People and businesses borrow for cars, college, or to grow shops. What do central banks have to do with this? A lot! When they cut rates, borrowing money gets cheaper. This can make folks feel richer. They spend more because loans are easier on the pocket.

This isn’t just about more shopping. Companies invest in new gear or hire more hands. All this action pumps up the economy. But flip that around. If central banks lift rates, loans cost more. People might hold tight to their cash. They’ll think twice about a new fridge or a holiday. Businesses might pause plans to expand. This can slow things down. The whole game plays on a field set by interest rates.

You see, central banks use interest to steer the economy. They find a balance that helps both savers and borrowers. They aim for just enough growth. But too much money flying around can mean inflation. That’s when things cost more and money’s worth less. Rate changes are a big deal. They touch your wallet, job, and even your future plans. So, when the Federal Reserve makes a move, it’s smart to watch and understand.

Long-Term Implications of Interest Rate Policies

Retirement Funds and Savings Under Fluctuating Rates

What happens to retirement funds when interest rates go up or down? It’s simple: they can grow or shrink. High rates can help savings grow. This is good for people who save a lot, like retirees. But there’s a twist.

High rates often slow down the economy. This can hurt stocks, where many retirement funds invest. Retirement accounts can lose value if stocks drop. So, when rates change, it’s like walking a tightrope.

People saving for the future must watch these changes. They should decide where to put their money wisely. A mix of stocks and safer bets, like bonds or savings accounts, can help. It’s about balance and being ready for rate ups and downs.

It’s not just retirees who feel this. All savers must think about rate changes by central banks. They control the cash flow and credit in our economy. This affects how much you’ll get from saving. It’s vital to keep an eye on these changes.

Global Economic Influence and Currency Valuation in Response to Policy Rate Decisions

Central banks, like the US Federal Reserve, make big choices. They decide on the benchmark interest rate. This rate is key for global cash flows.

When the US changes its rates, it sways the whole world. A rate hike can mean the dollar gets stronger. A stronger dollar can make imports cheaper. But it can make it tough for US companies to sell abroad.

Our dollars can buy more or less, depending on these rates. This can help or hurt trade between countries. That’s the trade balance effect. When the dollar is strong, other countries might find our goods pricey. This can shift the balance of trade.

Also, when rates shake up, your trips abroad could cost more, or less. This change in currency value touches many parts of the economy. It’s big for travelers, businesses, and even how countries work with each other.

These policy rate decisions don’t just stay at home. They travel far and wide. They’re part of a giant web linking cash, prices, and money moves around the globe. Understanding these ties helps us all. It helps us make smart choices in saving, spending, and planning for tomorrow.

In this post, we dove deep into how central banks set interest rates. We saw how these rates help control the economy. We learned that the Federal Reserve uses rates to keep growth steady and prices stable. It’s like steering a ship in open waters, trying to avoid bad weather.

We also talked about how changes in rates ripple through the economy. High rates can slow things down, while low rates can speed things up. It’s a delicate balance. This dance between rates and growth is constant.

Then we looked at how these rate changes hit our wallets. From buying a house to paying off a loan, the kind of deal you get can change. It’s crucial to know this when you’re planning big money moves.

Finally, we thought about the future. Retirement funds and global money trends can shift with rate changes. It’s a big world, and these little rate tweaks can end up making waves across the globe.

The bottom line? Rates set by central banks touch everything. From your home loan to an international investor’s big moves, it’s all connected. Keep an eye on these rates—they help write our economic stories.

Q&A :

How do Central Bank Interest Rates Affect the Economy?

Central Bank interest rates, often referred to as the ‘base’ or ‘benchmark’ rates, are crucial in guiding the economic activity of a country. These rates influence the cost of borrowing for banks, which then impacts the rates they offer to consumers and businesses. Lower interest rates can stimulate spending and investment as loans become cheaper, potentially boosting economic growth. Conversely, higher rates can help dampen inflation and cool off an overheating economy by making borrowing more expensive and encouraging savings.

What is the Relationship Between Central Bank Interest Rates and Inflation?

The relationship between Central Bank interest rates and inflation is inversely proportional. Central Banks, like the Federal Reserve in the US, use interest rate adjustments as a tool to control inflation. When inflation is high, Central Banks may hike interest rates to reduce consumer spending and borrowing, leading to a slowdown in the velocity of money, which can help reduce inflation. On the flip side, if inflation is low and the economy needs a boost, Central Banks might cut interest rates to encourage more spending and investment.

Can changes in Central Bank Interest Rates Impact the Stock Market?

Yes, changes in Central Bank interest rates can have a significant impact on the stock market. Increased rates can lead to higher borrowing costs for companies, which can reduce their profits and, in turn, affect their stock prices. This action can also shift investor preferences, as higher interest rates may make bonds and savings accounts more attractive compared to stocks. On the other hand, rate cuts can lead to a surge in stock market activity as cheaper borrowing costs can increase corporate profits and equity investments become more appealing due to lower returns on savings and bonds.

How do Central Bank Interest Rates Affect the Value of a Currency?

Central Bank interest rates are one of the key determinants of a currency’s value. If a Central Bank raises its interest rates, it can increase the demand for that currency because higher returns are possible on investments denominated in that currency. This increased demand can boost the currency’s value on the international market. Conversely, if the Central Bank lowers rates, the currency might depreciate as global investors seek higher yields elsewhere.

What are the Long-Term Impacts of Central Bank Interest Rate Changes?

The long-term impacts of Central Bank interest rate changes can include altered economic growth patterns, variations in employment rates, and structural shifts in saving and investment behaviors. Consistently high-interest rates can lead to reduced borrowing and spending, potentially stunting economic growth and leading to higher unemployment. Conversely, persistently low rates may encourage excessive borrowing and risk-taking, possibly resulting in economic bubbles. Central banks aim to balance these rates to promote sustainable long-term economic health.