Imagine your money sleeping safely right in your pocket, not in a bank. The rise of Central Bank Digital Currencies (CBDCs) threatens to shake up finance as we know it. With faster transactions and fewer fees, CBDC could lead to bank disintermediation, making traditional banks sweat. Can our trusted banks stay afloat in the face of this digital wave, or will they sink? Let’s dive into the emerging world where your cash and coins get a tech-savvy twist.

Understanding the Impact of CBDC on Traditional Banking

CBDC Impact on Banks and the Shifting Role of Financial Intermediation

Banks have always been the go-to for keeping our cash safe. They helped move money and gave out loans. But now, we hear about CBDC – a central bank digital currency. People wonder, will banks still matter?

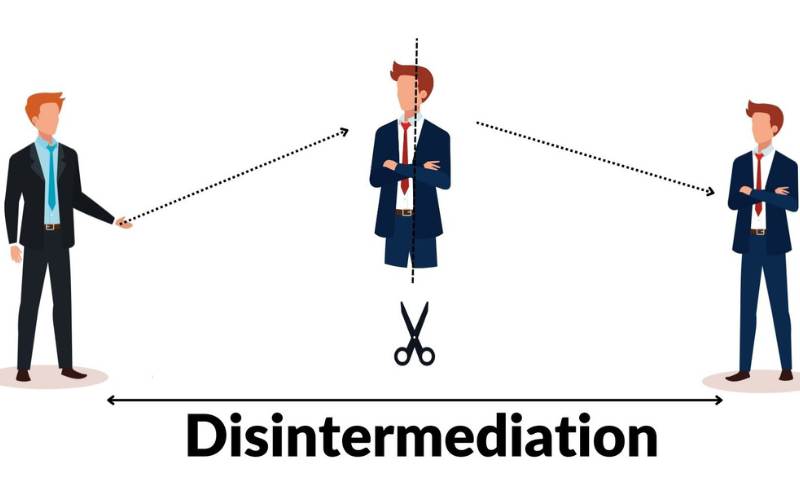

Sure they will. But their job will change. With CBDCs, central banks could offer accounts directly to people. This is scary for banks because it could cut them out of the picture. It’s a term called disintermediation. It means we might not need the middleman – banks – as much.

Yet, banks won’t just disappear. They have something CBDCs don’t – a strong link with customers. Banks know how to handle our money and give advice. That’s their edge. CBDCs might just make banks up their game. They could focus more on services and advice, less on handling cash.

Traditional Banking vs CBDC: Competing or Complementary Systems?

Some folks think it’s a battle: banks versus CBDCs. Who will win? I don’t see it that way. It’s not about one replacing the other; it’s about working together.

CBDCs are about easing the flow of money. They make payments fast and easy, with a click. Banks, on the other hand, have the trust and history. They offer loans, credit cards, and savings. CBDCs are a tool, not a foe.

Together, banks and CBDCs could shape a smarter money world. Like friends, they can pair up. Banks could use CBDC to move money around. Or offer digital wallets that hold CBDC. They can grow with the tech, not fight it.

Let’s put it this way: banks and CBDCs could be like peanut butter and jelly. Different, but great when combined. CBDCs speed things up, banks add the personal touch. You could get your salary in CBDC but go to a bank for a mortgage.

It’s about choice. We need it all – digital convenience and human advice. Over time, CBDCs could mean banks focus more on the things computers can’t do. The human stuff – like working out what loan fits you best.

Will CBDCs replace banks? No, but they will spark changes. Banks will adapt. This is good for us – the customers. We get the best of both worlds. Fast money moves and smart advice where needed. That’s a win-win.

The Technical Foundation: Blockchain’s Role in CBDCs

Blockchain CBDC Technology and Its Advantages for Secure Transactions

Blockchain is the backbone of CBDC tech. It’s like a digital ledger that’s very safe. Each block of data is linked to the one before, creating a chain. So, if you change one block, every block after that shows the change. This makes it super hard for bad guys to mess with it.

Banks now look at this tech for digital currency. They call it central bank digital currency or CBDC. With CBDC, you can send and get money quick and safe. It is like having digital dollars in your phone’s wallet. No more waiting for checks to clear or worrying about cash in your pocket.

And get this, CBDC could cut costs. Right now, banks spend lots on moving money. But with CBDC, they can do it with less cost and faster. That’s good for banks and for us! Plus, CBDC means we can see every move the money makes. That helps keep things honest and decide if money is where it should be.

Interoperability with CBDC: Facilitating Seamless Financial Operations

Interoperability with CBDC is also key. Think of it like this: you have a toy train set. You want your train to run on tracks from different sets. Same with banks and CBDC. Different banks’ systems should work well together. This lets you pay anyone, anywhere, without worry.

CBDC must work with old and new money systems. That means your digital wallet could hold both dollars and CBDC. This combo lets banks stay important while they also offer the cool new CBDC. It’s like the best of both worlds.

With CBDC, you could also send money to friends in other countries without a hitch. No more waiting days for your cash to show up. This could change how we think about money around the world!

But there are big questions too. Like, can the CBDC system handle many folks using it at once? Will it work as fast as we need it to? Banks must test CBDC a lot to answer these questions. They must make sure it’s rock solid and everyone can use it. And they need to make sure it’s really, really safe. Nobody wants hackers getting into their digital wallets!

In the end, blockchain and CBDC could make money matters a lot simpler. Less time for transactions and better security? Yes, please! It might seem tricky, but it’s all about making the money world safer and faster for all of us. With some smart thinking, banks and CBDC can help everyone get along in the money world.

Regulatory and Policy Considerations in CBDC Implementation

CBDC and Banking Regulations: Balancing Innovation with Financial Stability

Picture a world where you pay for groceries with a digital coin. It’s not Bitcoin; it’s money from your central bank. This world isn’t far off. Central Bank Digital Currencies, or CBDCs, are entering our lives. I’m here to help you see how they’ll change the banking game.

CBDCs could shake up our banking system. Banks play a big role today. They keep our money safe, give loans, and make sure money flows. But what happens when the central bank steps in? Do we still need banks the same way?

The impact of CBDCs on banks is huge. If the central bank offers its own digital currency, people might want to store money there, not with other banks. This is one reason why banks won’t just sit back. They’ll find new ways to keep us coming. Maybe they’ll offer better services or new perks. They have to stay useful in a CBDC world.

Now, let’s talk rules. We love the new toys that technology brings, but don’t forget that trust is the foundation of money. Banks follow strict rules to keep that trust. CBDCs make us ask: will the same rules apply to digital coins from the central bank?

Here’s how this might look: you go to the central bank’s app to send some digital cash. The bank has to check who you are, right? Well, these are called KYC rules – “Know Your Customer.” They stop bad guys from using money for bad things. AML, or “Anti-Money Laundering,” is another set of rules to stop crime.

CBDCs mean we have to think about these rules in new ways. This fresh digital currency has to be safe and sound. And it must follow the same serious rules banks do. Everyone should know their money is in good hands, and not helping the wrong people.

KYC/AML Considerations for CBDC: Ensuring Compliance in the Digital Age

Okay, let’s dive deeper into this digital money pool. Say you’ve got a wallet app for your CBDC. Just like you wouldn’t want someone swiping your wallet at a park, you don’t want them hacking your digital one. And you also don’t want your digital dollars helping crooks, do you?

Enter KYC and AML rules. They’re the guard dogs of the financial world. For CBDC, these rules make sure no one can use that money to hide their shady deals. It’s like putting up a big “No Trespassing” sign for criminals.

But it’s tricky. With digital wallets for CBDC, everyone’s watching. People worry about their privacy. They want to make sure no one’s peeking at their money moves. So, our CBDC systems have to be tight. They have to block the bad guys without peeking into your business more than they need.

Cross-border payments with CBDC can be a game-changer. Sending money across the world could be as easy as sending a text. But these quick moves can’t skip the rules. We’ve got to make sure the money moves fast but still plays by the rules. And with peer-to-peer CBDC transactions, it’s the same. Fast, easy, but yes, following the rules.

In the end, CBDCs bring tons of questions. How will banks stay in the game? How will they match this new tech? And how do we keep it all safe and fair? These are the big puzzles we need to solve. But one thing’s for sure: it’s a new day for money, and I’m here to help you get ready for it.

The Future Landscape: How CBDC May Reshape the Banking Industry

Disintermediation Risks: Could CBDCs Lead to Bank Obsolescence?

Let’s talk about how your bank might change. Imagine a world where you pay for everything with a click on your phone. No need to visit a bank or use cards. Central Bank Digital Currencies (CBDCs) could make this real. They are like money in your bank but are digital and run by the country’s bank. This means that when you use CBDCs, you’re dealing directly with the central bank.

Now, why does this matter to your usual bank? Because CBDCs might lead banks to become less needed. Think about a game where suddenly there’s a shortcut and you don’t need a key player anymore. That’s how banks might feel. They’re used to being in the middle of your money matters, but with CBDCs, that might change.

Banks bring savers and borrowers together—they’re a bridge. With CBDCs, you might not need the bridge. This is called “disintermediation,” a big word that means “cutting out the middleman.” If the central bank becomes your go-to for daily money needs, banks have to figure out new ways to stay important.

Now, could CBDCs push banks into the shadows? It’s too early to say that. Banks do a lot more than hold money. They give loans, offer advice, and help businesses grow. They will keep doing these things, but they’ll also have to find fresh ways to be useful.

Retail Banking Strategies CBDC: Adapting to the Advent of Central Bank Digital Currencies

So, how can your bank stay in the game? They’ve got to adapt. Banks could become super good at customer service. They can offer you new services that blend nicely with CBDCs. They can make their apps rich with features that make your life easier.

Another strategy is for banks to focus on what a digital currency can’t do alone. They could give better loans, help you save smarter, and help businesses big and small. They could also become safe-keepers for your digital money, adding layers of security and privacy that you might not get elsewhere.

Banks have to think like you, the customer. Say you use a digital wallet for CBDCs but also need help planning for a house or college. Your bank could be that friend who’s there to guide you. They could mix their know-how with new tech, making a killer combo that’s hard to beat.

In time, these digital dollars could be the norm for buying stuff from other countries or sending money to friends far away. Banks will need to play a part in making these cross-border payments swift and secure.

To sum it up, CBDCs are set to shake up the banking world. Yet, it’s not the end for banks; it’s just a call to gear up. They’ve got to evolve, play to their strengths, and offer you, the customer, something that keeps you coming back. Change is part of money’s history, and banks that adapt will surely find their place in a future where money is just bits and bytes.

So get ready for a wild ride in the money world, with CBDCs and banks both aiming to win your trust. It’s an exciting time, and I’m here to unpack it all as we watch the landscape of banking unfold.

We’ve explored how CBDCs might change banking, from shifting the roles banks play to how they could work with or against traditional systems. We delved into the tech side with blockchain’s role and the benefits it brings for safe money moves. We then tackled the big rules and policies, keeping banks in check while forging ahead with innovation and making sure every digital dollar is clean and clear.

Looking ahead, we see that banks face real shake-ups with CBDCs on the rise. They’ll need smart moves to stay in the game. So, what’s the bottom line? CBDCs are an exciting step but come with challenges. Banks aren’t going anywhere fast, but they’ll need to adapt, staying alert and agile in a digital world. Let’s watch this space – the future of money is unfolding right before our eyes.

Q&A :

What is CBDC and how might it affect traditional banking?

Central Bank Digital Currency (CBDC) refers to a digital form of a country’s fiat currency, which is issued and regulated by the nation’s central bank. With the potential to streamline payment systems and reduce transaction costs, CBDCs could significantly impact traditional banking by offering an alternative to conventional bank deposits and facilitating direct transactions between parties without the need for bank intermediation.

Can CBDC lead to bank disintermediation?

Yes, CBDC has the potential to lead to bank disintermediation by enabling consumers to hold their funds directly with the central bank, which may reduce the need for traditional bank accounts. This shift could diminish the role of commercial banks in the financial system, affecting their ability to provide loans and other financial services through the traditional deposit-lending model.

How might commercial banks respond to the rise of CBDCs?

Commercial banks might adapt to the rise of CBDCs by evolving their business models to focus on services that cannot be directly provided by a CBDC, such as personalized financial advice, investment products, and risk management services. Additionally, banks may enhance their own digital offerings, improve customer experience, and establish partnerships or integrations with the CBDC network to maintain their relevance in the financial ecosystem.

What are the advantages of CBDC over traditional banking methods?

CBDC offers several potential advantages over traditional banking methods, including reduced transaction times and costs, improved financial inclusion, better traceability of funds, and enhanced security features. These benefits stem from the digitized nature of CBDC and its potential to operate on innovative technologies such as blockchain, which could streamline payment systems and cut out intermediaries.

How could consumers and businesses benefit from the implementation of a CBDC?

Consumers and businesses could benefit from the implementation of a CBDC through easier access to financial services, especially for those underserved by traditional banks. A CBDC can offer a more inclusive payment system with lower barriers to entry. Businesses could also see improvements in cash management efficiency and faster settlement of transactions, which would speed up the flow of goods and services.